This formation is a strong signal to exit longs and, if so inclined, enter short – to be used as a sell signal or a “stop and reverse” signal (Chart 13). The most common Dojis look like a cross (+) and aren’t considered a reversal signal. However, the fact there have been price oscillations above and below the opening price, supply and demand canceled one another. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. Typically, Dragonfly Dojis appear at either the bottom of a downtrend or the top of an uptrend. In Japanese, doji means “blunder” or “mistake”, referring to the rarity of having the open and close price be exactly the same.

- The Dragonfly pattern typically forms when the asset’s high, open, and close prices are the same.

- A spinning top bar has a small real body and long upper and lower shadows.

- Dragonfly doji candlesticks are reversal candlesticks found at the bottom of downtrends.

- It’s formed when the asset’s high, open, and close prices are the same.

If entering long on a bullish reversal, a stop loss can be placed below the low of the dragonfly. If enter short after a bearish reversal, a stop loss can be placed above the high of the dragonfly. The candle following a potentially bearish dragonfly needs to confirm the reversal. The candle following must drop and close below the close of the dragonfly candle. If the price rises on the confirmation candle, the reversal signal is invalidated as the price could continue rising.

Dragonflies candle

You should consider whether you can afford to take the high risk of losing your money. Each day we have several live streamers showing you the ropes, and talking the community though the action. What we really care about is helping you, and seeing you succeed as a trader. We want the everyday person to get the kind of training in the stock market we would have wanted when we started out. Reversals usually happen when a stock hits support or resistance and does not break. For example, you can use moving average lines like the simple moving average or VWAP to guide support and resistance.

The buying pressure got to a point where the price was back to $5 – back to the Open price. The Bulls managed to support price at $5 until the candle Close (Refer to Image 3). Opposite to the Gravestone Doji in our last post, The Dragonfly doji can https://g-markets.net/ be spotted as a “T” candlestick on a chart. The price breakdown of the doji suggests a complete Buy-back of a once Red Candlestick (Refer to “Low” in Image). Essentially wiping off any price decline the candlestick may have had (refer to image ).

This pattern resembles the shape of a dragonfly with an extended lower shadow. It provides bullish signals and is considered a neutral continuation or reversal pattern, depending on its context within a trend. The meaning of a dragonfly doji is that there is uncertainty in the market, and traders are prompted to carefully analyse other factors before making trading decisions. To effectively use the dragonfly doji, traders should focus on identifying the pattern on price charts and interpreting its meaning in the context of the current market conditions. By combining this knowledge with technical analysis and other indicators, traders can develop a robust trading strategy that takes advantage of potential trend reversals and market movements.

Our candle studio

A dragonfly doji is considered a signal of a potential reversal in the security price. It occurs when the open, close, and high prices of a security are virtually the same. Thus, a dragonfly doji is T-shaped without an upper tail, but only a long lower tail. The price wasn’t dropping aggressively coming into the dragonfly, but the price still dropped and then was pushed back higher, confirming the price was likely to continue higher. Looking at the overall context, the dragonfly pattern and the confirmation candle signaled that the short-term correction was over and the uptrend was resuming. Following a price decline, the dragonfly doji shows that the sellers were present early in the period, but by the end of the session the buyers had pushed the price back to the open.

7 Mosquito-Repelling Gimmicks to Steer Clear Of – High Plains Journal

7 Mosquito-Repelling Gimmicks to Steer Clear Of.

Posted: Wed, 16 Aug 2023 07:00:00 GMT [source]

The Dragonfly should be verified by waiting for trend confirmation on the following day. We research technical analysis patterns so you know exactly what works well for your favorite markets. The shape is the direct result of the opening of a trading day at a downtrend. And it is subsequently reversed in time to close near the opening price. A Dragonfly Doji candlestick pattern is one of the four different types of Doji candlesticks. However, as the candle played out, bulls started to buy-back the asset quite heavily (Refer to Image 2).

Gravestone Doji vs Long-Legged Doji

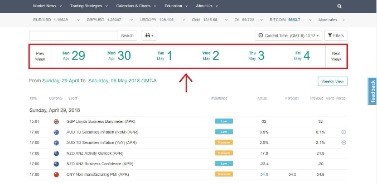

When trading the Dragonfly Doji, we want to see the price first going down, making a bearish move. Sellers emerged on the rally as the market is long the underlying instrument. Confirmation can only be determined at the close of the following day. The price of the main cryptocurrency rose above the level of 26k USD. This was fueled by the news that Ark Invest and 21Shares filed applications with the US Securities and Exchange Commission (SEC) for a spot ETF on Ethereum.

This may be a chance for additional entry points, especially if the market has a higher open on the following day. The dragonfly doji is a Japanese candlestick pattern that acts as an indication of investor indecision and a possible trend reversal. As mentioned above, the other two types of doji patterns are the gravestone doji and the long-legged doji. The low, open, and close prices of a gravestone doji are at the same level.

Technical View Nifty forms Dragonfly Doji pattern; all eyes on 18,500 mark – Moneycontrol

Technical View Nifty forms Dragonfly Doji pattern; all eyes on 18,500 mark.

Posted: Wed, 10 May 2023 07:00:00 GMT [source]

The color of the Dragonfly Doji (green or red) provides further insight into market sentiment. After talking about hammer patterns and dragonfly, gravestone, and other Doji formations, let’s explore additional candlestick price patterns that traders find useful when trading. A Doji candlestick means that the trend has slowed down – but it does not imply an immediate reversal. This dragonfly candlestick is a frequent misinterpretation leading to the incorrect use of Dojis by some traders. Despite the odds of a market turn increasing with a Doji, it still lacks a confirmation to be traded upon. In that sense, if the price on the next candlestick moves materially higher or lower on the close, it either refutes or confirms the direction of the prevailing trend (Chart 10 below).

A gravestone doji occurs when the low, open, and close prices are the same, and the candle has a long upper shadow. The gravestone looks like an upside-down “T.” The implications for the gravestone are the same as the dragonfly. Both indicate possible trend reversals but must be confirmed by the candle that follows.

Free Trading Courses

Like all others, this pattern does not guarantee that the price will behave in any specific way; however, identifying Dragonfly Dojis is helpful for any trader. The bearish version of the Dragonfly Doji is the Gravestone Doji. It looks like an upside-down version of the Dragonfly and it can signal a possible downtrend. A step by step guide to help beginner and profitable traders have a full overview of all the important skills (and what to learn next 😉) to reach profitable trading ASAP. It is very easy to identify a Dragonfly Doji pattern in a candlestick chart because of the courtesy of its unique “T” shape.

- Since we are looking for moves to the upside, we want to trade the Dragonfly Doji using support levels.

- The gravestone looks like an upside-down “T.” The implications for the gravestone are the same as the dragonfly.

- The Dragonfly Doji is considered a robust and reliable signal in these situations.

- The low, open, and close prices of a gravestone doji are at the same level.

Candlestick is a type of charting that contains the open, close, high, and low prices of an asset for a specific time period. Candlestick charts are more informative than typical line charts, which only provide the close price or average price. Thus, candlestick charts are more prevalently used in technical analysis than line charts.

Every day people join our community and we welcome them with open arms. We are much more than just a place to learn how to trade stocks. Yes, we work hard every day to teach day trading, swing trading, options futures, scalping, and all that fun trading stuff.

The Hammer has a small body at the top, while the Dragonfly Doji has little to no body. Both patterns indicate an increase in buying pressure and require confirmation from subsequent bullish candlesticks to validate the trend reversal. A spinning top bar has a small real body and long upper and lower shadows. The main difference between the dragonfly and the spinning top is that there is little/no upper shadow in the former. A dragonfly indicates a stronger bullish signal than a spinning top, as it suggests a potential trend reversal.

We put all of the tools available to traders to the test and give you first-hand experience in stock trading you won’t find elsewhere. Trading contains substantial risk and is not for every investor. An investor could potentially lose all or more of their initial investment. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success. Sometimes the stock price doesn’t show its value because it has fallen so low.

Same as the dragonfly, the gravestone doji also indicates potential price reversals and requires confirmation candlesticks. The dragonfly doji should not be relied on as a standalone signal. Additionally, traders should consider the overall market conditions and look for any conflicting signals. It’s important to remain patient and wait for a clear confirmation before making any trading decisions based on the dragonfly doji pattern. In summary, while both the Hammer and Dragonfly Doji patterns signal potential bullish reversals after a downtrend, they differ in their formation.