Content

Foreign direct investment, such as reinvested earnings, equities, and debt. Foreign private purchases of a country’s government bonds, such as U.S. Erika Rasure is globally-recognized as a leading consumer economics subject matter expert, researcher, and educator.

A normal account balance shows whether an account is a debit or a credit. Similarly, it specifies whether it will be on the left or right side of the trial balance. Normal account balance is a crucial part of the double-entry accounting concept. Account balances in accounting are crucial in showing the financial position of an entity.

Examples of account balance

Account Balance Definition institutions make available the current value of account balances on paper statements as well as through online resources. Direct transfers also include a government’s direct foreign aid. That’s when a country’s residents or businesses invest in ventures overseas.

- Your current balances take into account all of your money, including both the amounts that are currently accessible and those that are being held.

- Purchases include all consumer spending as well as business growth and government infrastructure spending.

- As was previously stated, this may involve checking as well as savings accounts.

- In banking, it represents the remaining money in a bank account ready for spending.

Primarily, it shows the side of the trial balance on which these account balances will go. Understanding normal accounting balances is straightforward with the help of the accounting equation. A money market account combines the features or both a savings and checking account.

Mobile and online

This information is not a recommendation to buy, hold, or sell an investment or financial product, or take any action. This information is neither individualized nor a research report, and must not serve as the basis for any investment decision.

- Currently, ABC Co. holds a bank balance of $50,000 in this bank account.

- Most financial companies, such as banks and credit card issuers, send monthly statements to customers so they can get an update of their account balance each month.

- Also, any debt rolled over from previous months represents an account balance on credit.

- In an accounting period, “balance” reflects the net value of assets and liabilities to better understand balance in the accounting equation.

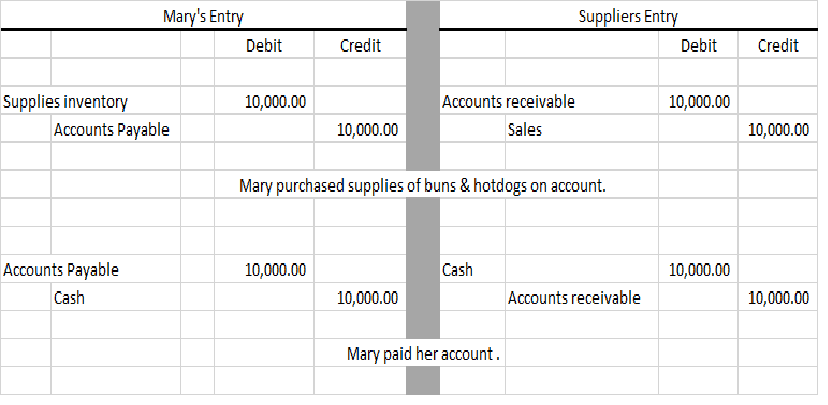

The debit or credit balance that would be expected in a specific account in the general ledger. For example, asset accounts and expense accounts normally have debit balances. Revenues, liabilities, and stockholders’ equity accounts normally have credit balances. Comparatively, account balances on credit cards show the total amount owed to the credit account at the beginning of a statement cycle. Also, any debt rolled over from previous months represents an account balance on credit. An account balance is the amount of money present in a financial repository during the current accounting period. It is the net difference between the credits and debits posted in any given accounting cycle, added to the balance carried forward from the previous month.

Investment services

However, this term does not apply to savings or checking accounts; it is only applicable to loan accounts. Based on accounting practices, each type of account in the financial statements is either a debit or credit. These practices dictate how companies should classify those accounts. Usually, these normal balances also fall on the relevant side of the accounting equation. Any items on the left side of the accounting equation are debits, while those on the right are credits.

How do you calculate account balance?

You get that by adding money received and subtracting money spent. Cash balance is the amount of money on hand.

All investments involve risk, including the possible loss of capital. Before making decisions with legal, tax, or accounting effects, you should consult appropriate professionals.

Company

In a single day, a store generates a total of $10,000 in new sales , and issues $1,500 in refunds . The store’s revenue account has a net credit balance for the day of $8,500. The process of accumulating an accounting balance in banking involves several steps. Both of the above paragraphs touched on the topic of account balances. However, they discussed the concept under two separate fields or areas.

Therefore, the https://personal-accounting.org/ balance shows the residual amount after deducting the credit balances from the debits. One of the account balances reported under the assets category is accounts receivable. This account represents balances owed to ABC Co. from its customers. The accounts receivable balance presented on the company’s balance sheet is $250,000.

Account balance definition

The available credit is the unused fraction of credit that is currently available on a credit account. Available credit, as with account balance, significantly influences the credit score. Available credit refers to the amount remaining of the credit line you have been given. The available credit can be determined by subtracting the account balance from the credit limit. For example, if your credit limit is $2,000 and you have an account balance of $1,250, the available credit is $750.